Corporate Taxation and Dividends Explained

In this article we will be going over several key areas that are needed to be discussed to fully understand the taxation of dividends in Canada.

Outline:

- Canada Corporate Tax Rates

- General Tax Rate

- Small Business Deduction (SBD)

- Types of Dividends

- Dividend Gross-up and Tax Credit

Canada Corporate Tax Rates

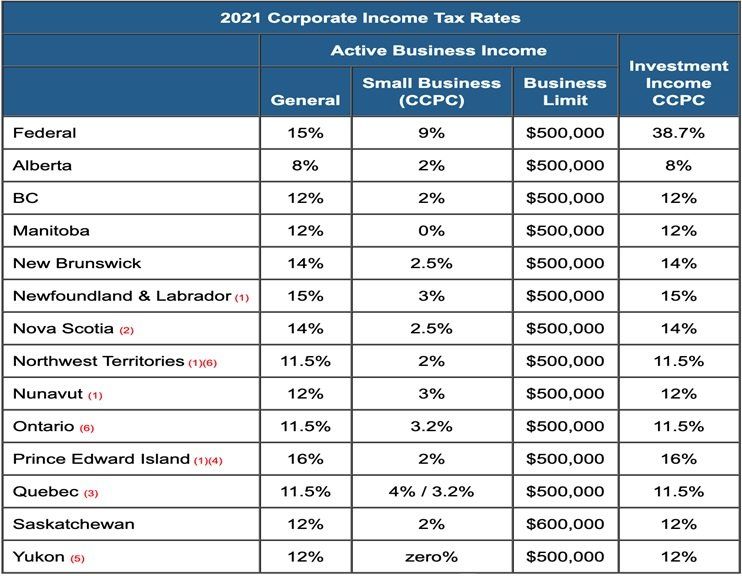

In Canada, Small Businesses have access to two different types of tax rates on their active business income. There is the General Rate and the Small Business (CCPC). The total rate is found by adding both the Federal rate and your Provincial rate together. In every province except Saskatchewan there is a limit of $500,000 that a business can utilize the Small Business tax rate. (Source: TaxTips.ca)

General Tax Rate

The general tax rate is applied to active income within a Canadian corporation that is over the Business Limit. In most cases this limit is $500,000 except Saskatchewan. When a corporation pays the general tax rate on it's active income, the after-tax profits are added to a notional account called the General Rate Income Pool (GRIP).

It is from this notional GRIP account that Eligible dividends can be paid to shareholders. Eligible Dividends are paid from after-tax profits that have had the General Tax Rate applied to it.

Small Business Deduction

The small business deduction (SBD) is available to Canadian corporations up to the business limit. As you can see from the chart above, the SBD is a much lower tax rate than the general tax rate. This is an incentive for small businesses to have more after-tax capital to put back into their business creating more growth and economy in Canada. When a corporation pays the small business rate on it's active income, the after-tax profits are added to a notional account called the Low Rate Income Pool (LRIP).

It is from this notional LRIP account that Non-Eligible dividends can be paid to shareholders. Non-eligible Dividends are paid from after-tax profits that have had the Small Business Rate applied to it.

Note: There is two factors that can reduce a corporation's Business Limit. When the business has taxable capital exceeding $10M then the limit will start to be reduced and is completely eliminated when taxable capital reaches $15M. Also, for taxation years after 2018, when passive investment income is earned within the corporation or associated corporations this will also reduce the business limit. When the aggregate amount of passive income starts to exceed $50,000 the business limit will start to be reduced and is completely eliminated when the passive income exceeds $150,000.

GRIP and LRIP Example:

Alberta manufacturing business earns $580,000 after-tax income within the corporation:

- $500,000 is added to the LRIP balance - Can be paid to shareholder(s) as non-eligible dividend

- $80,000 is added to the GRIP balance - Can be paid to shareholder(s) as eligible dividend

Types of Dividends

There is three different types of dividends that can be paid to shareholder(s) in Canada.

- Eligible Dividends (Paid from the General Rate Income Pool)

- Enhanced gross-up and tax credit as corporate income was taxed at higher general tax rate

- Gross-up Rate = 138%

- Dividend Tax Credit = 15.0198% (Federal)

- Non-Eligible Dividends (Paid from the Low Rate Income Pool)

- Reduced gross-up and dividend tax credit as corporate income was taxed at reduced rate

- Gross-Up Rate = 115%

- Dividend Tax Credit = 9.0301%

- Capital Dividends (Paid from the Capital Dividend Account)

- Tax-Free dividends that can be paid to shareholder(s)

- Capital Dividend's are created through the tax-free portion of capital gains and life insurance

Dividend Gross-up & Tax Credit

The dividend gross-up and tax credit may seem like a confusing system at first glance, but in reality it's quite simple. When a dividend is paid to a shareholder there is a gross-up of the dividend firstly, and then a corresponding tax credit that is applied after to lower the overall taxes due. The reason behind the gross-up and tax credit is because of a theory known as "Integration". This theory which in practice is quite effective, enables equality between shareholders and employees. The CRA and department of finance want to level the playing field for business owners and employees alike, and through this theory of integration they want to ensure that any taxes that are paid will be the same regardless if you are a business owner or an employee.

With the gross up of the dividend we are essentially bringing the dividend back to it's pre-tax amount. Then a specific tax credit is applied which varies depending on the type of dividend the province. The deciding factor on overall taxes is the personal Marginal Tax Rate of the individual shareholder.

Let's look at an example of a shareholder who pays himself $2,000 in Eligible Dividends and $2,000 in Non-Eligible Dividends.

This shareholder has a Federal marginal tax rate of 26%.

We will only be looking at the Federal tax rate in this example.

Eligible Dividend - $2,000

- Gross-Up = $2,760 ($2,000@138%)

- Taxes Due = $717.6 ($2,760@26%)

- Tax Credit = $414.55 ($2,760@15.0198%)

- Effective Taxes = $303.05 ($717.6 - $414.55)

Non-Eligible Dividend - $2,000

- Gross up = $2,300 ($2,000@115%)

- Taxes Due = $598 ($2,300@26%)

- Tax Credit = $207.69 ($2,300@ 9.0301%)

- Effective Taxes = $390.31 ($598 - $207.69)

As you can see from the example above, the taxes that are due on the Eligible dividend are less than the taxes due on the Non-Eligible dividend. The reason behind this is the theory of integration. Because the corporation paid a higher tax rate on that income (General Rate), the individual pays less tax when they take that profit personally as a dividend.

Note: A tax credit is different than a tax deduction. A tax credit will effectively lower the taxes that are due, while a tax deduction lowers that overall income that the taxes are applied against.

I hope you found this article valuable and informative, please don't hesitate to reach out with any questions.